When Are C Corp Taxes Due 2025. The registrar of companies (roc) compliance calendar provides a comprehensive schedule of due dates for various filings and disclosures mandated. The fourth quarterly payment is due the year.

When are business taxes due in 2025 (for the 2025 tax year)? The tax deadlines for c corporations depends on if they follow a calendar or fiscal year:

What is Double Taxation for CCorps? The Exciting Secrets of Pass, Class c corporations using a calendar year will have their taxes due on april 15, 2025. For 2025, payment for the first quarter is due april 15, the second quarter on june 17, and the third quarter on september 16.

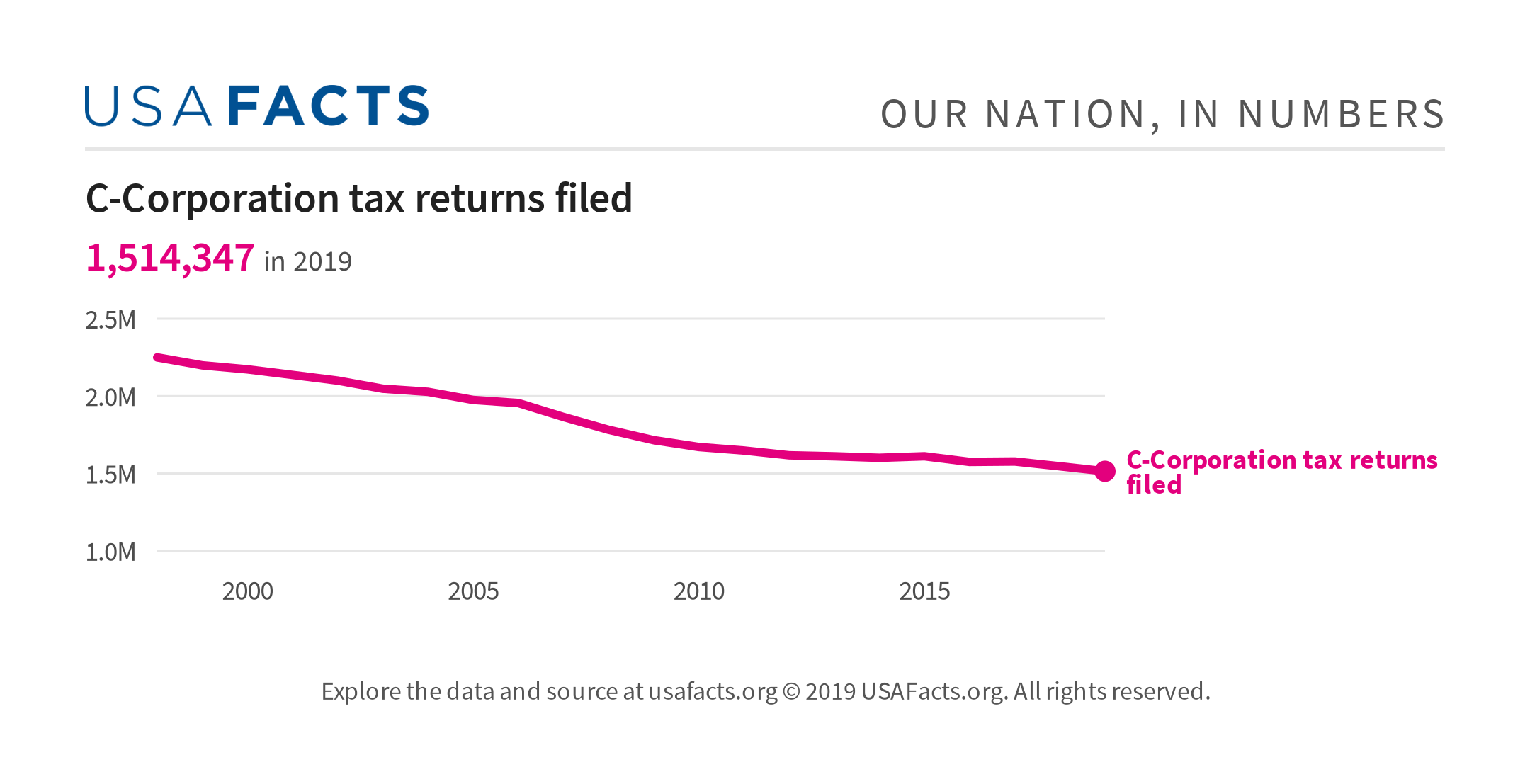

CCorporation tax returns filed USAFacts, This date marks the end of the fiscal year for businesses and is the last opportunity to submit. The deadline for c corporation to file their 2025 taxes is april 15, 2025.

C Corp Taxes Rates and Requirements Guide Block Advisors, When are c corp taxes due? If your company operates on a calendar year, you need to file irs form 1120 by this date.

What Is C Corp? Harvard Business Services, Inc., If you file an extension, the new deadline is october 15, 2025. The fourth quarterly payment is due the year.

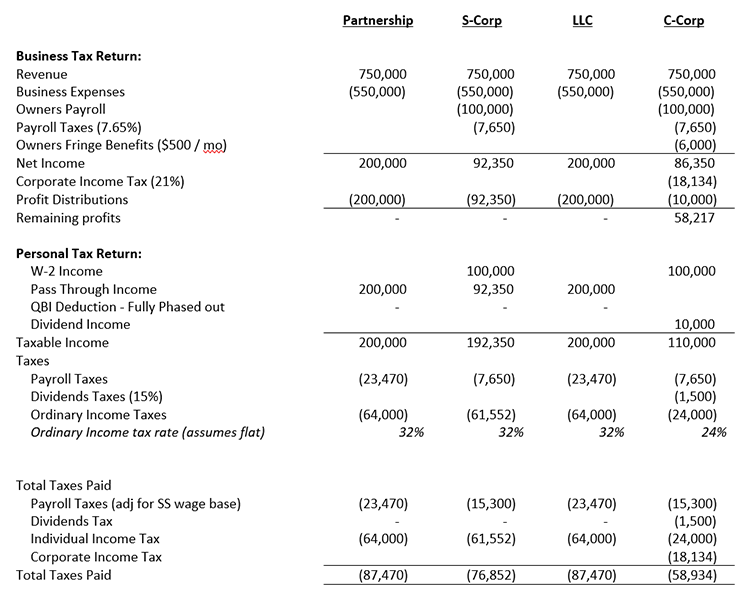

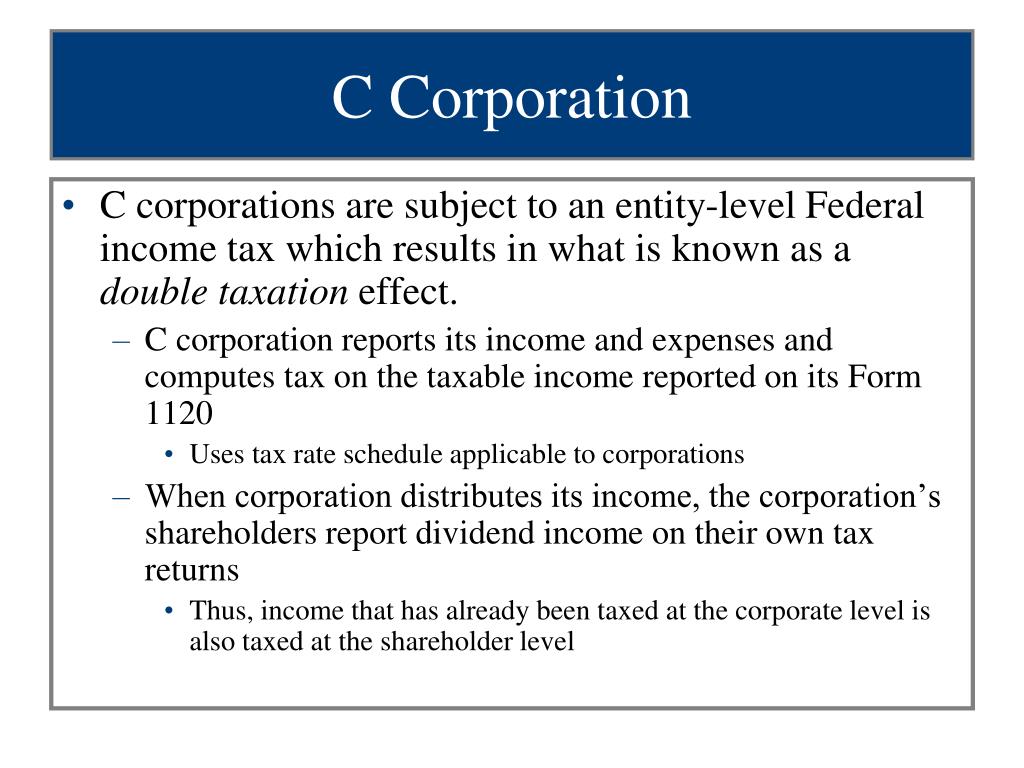

Tax Treatment for C Corporations and S Corporations Under the Tax Cuts, A c corp pays a flat 21% tax on income for federal taxes. You have right up until tax day to file for.

Everything You Need To Know About C Corporation Taxes, The tax deadlines for c corporations depends on if they follow a calendar or fiscal year: Generally, most individuals are calendar year filers.

PPT Chapter 17 PowerPoint Presentation, free download ID5680655, A c corp pays a flat 21% tax on income for federal taxes. So if you become an s corp for the year 2025, let’s say.

Taxing Businesses C corporations — Visualizing Economics, Quarterly instalments are due by the 25th day of the first month following the first, second, and. If you file an extension, the new deadline is october 15, 2025.

Tax Treatment for C Corporations and S Corporations Under the Tax Cuts, Download our free quarterly estimated tax. The fourth quarterly payment is due the year.

Everything You Need To Know About C Corporation Taxes, Generally, most individuals are calendar year filers. The due dates for these 2025 payments are april 15, june 17, september 16, and january 15 (2025).